Understanding how customer lifetime value (CLV) calculations fit into your digital marketing and customer acquisition cost (CAC) strategy gives your business a leg up when it comes to scaling your operations.

It’s every marketer’s dream: to be able to spend one dollar on advertising and get a dollar and ten cents back. In a dream world, with those unit economics, we’d be able to pour more and more money into the top of our sales funnel and know that we would be generating a positive return on invested capital. The reality, however, is that the days of being able to generate an immediate return via an e-commerce transaction, for example, are long gone. We can blame an over-saturated market of Google and Facebook advertisers for that. Over time, CPC bids have gone up and more and more money is spent chasing fewer dollars.

So what’s the fix? How can businesses tap into the power of these massive platforms to grow their businesses? Surely there is a way to advertise and generate some sort of a return that makes it reasonable to spend money advertising on Google and Facebook?

This is where Customer Lifetime Value (CLV) comes into the picture.

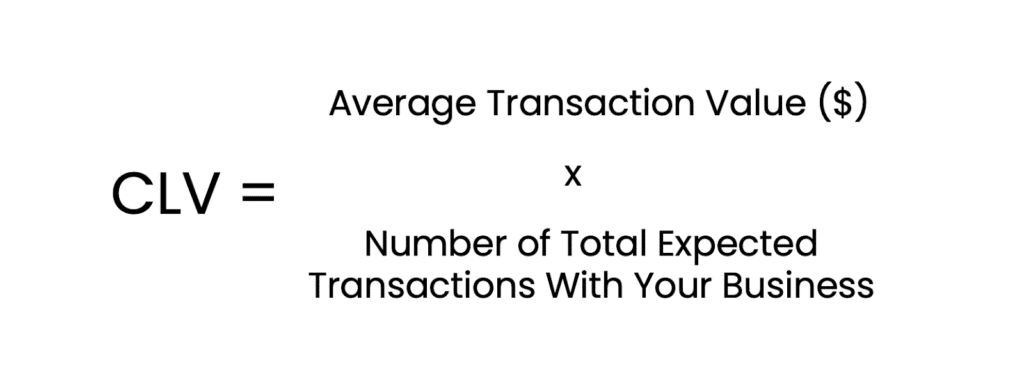

Customer Lifetime Value, or Lifetime Customer Value depending on where you look, is the average amount of money a customer spends with your business over the lifetime of their engagement with your business. For example, a customer might only spend $5 at your bakery today, but continue to frequent your business every week for 5 years. That equals a total spend of $1,300 from that customer over the lifetime of their engagement with your bakery.

Not bad at all!

Understanding the average number of times a customer visits your business and the average amount of money they spend at each of those engagements gives you insight into how much value you can extract from the customer – and, as a result, how much you can spend to acquire that customer.

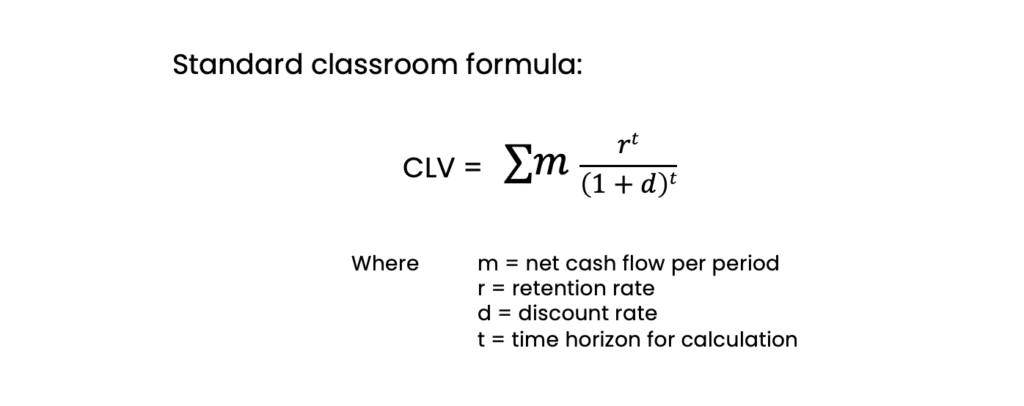

Now, there are several ways to calculate customer lifetime value. The textbook version requires understanding levels of insight about customers that few business owners, especially smaller business owners, have access to or the bandwidth to try to calculate.

The good thing is that calculating CLV need not be so esoteric. A simple equation for calculating the lifetime value of a customer, one that can be directly used in your advertising expenditure calculations, can be generated with this formula.

Then, let’s say your bakery has profit margins of 30% – you make 30% on each and every item sold at your store. Over the course of our example customer’s lifetime, you would extract $390 in profit from that one customer.

Knowing that you will generate, on average, $390 over the course of a customer’s lifetime with your business, you can now make a decision on how much you can spend to acquire this customer. If you are spending less the $390 in Google or Facebook advertising, for example, to get a customer to come to your bakery, you are now making the unit economics of customer acquisition cost (CAC) work for you.

Understanding your customer lifetime value (CLV) gives you, as the operator of your business, the opportunity to spend money upfront and know that you can generate a return. The mistake rookie marketers make is thinking that if they spend $200 in Google or Facebook ads today that they need to generate $250 (or more) in sales that day. This is a quick way to get frustrated, think that you are wasting money, and give up on potential scale that your business can tap into.

Returning to our bakery example. If we had decided to spend $200 a day on Google Ads, and we managed to attract – as a result of the advertising spend – one average customer to come through the doors of our bakery, we would be giving ourselves a chance to generate a positive return on that advertising spend as a function of the CLV of the new customer.